how to take an owner's draw in quickbooks

Enter and save the information. The draw comes from owners equitythe accumulated funds the owner has put into the business plus their shares of profits and losses.

If youre unable to edit the amount on this screen in some cases youll be able to do so by using its.

. Check this article for more information. Set up draw accounts. Recorded in Q as a transfer.

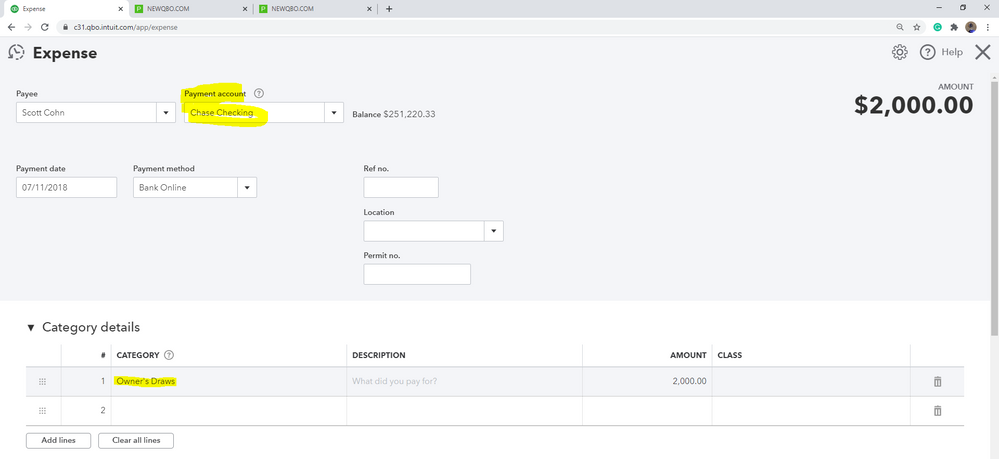

Locate your opening balance entry then choose it. This leads to a reduction in your total share in the business. Choose the Payee and the Bank Account used to withdraw the money.

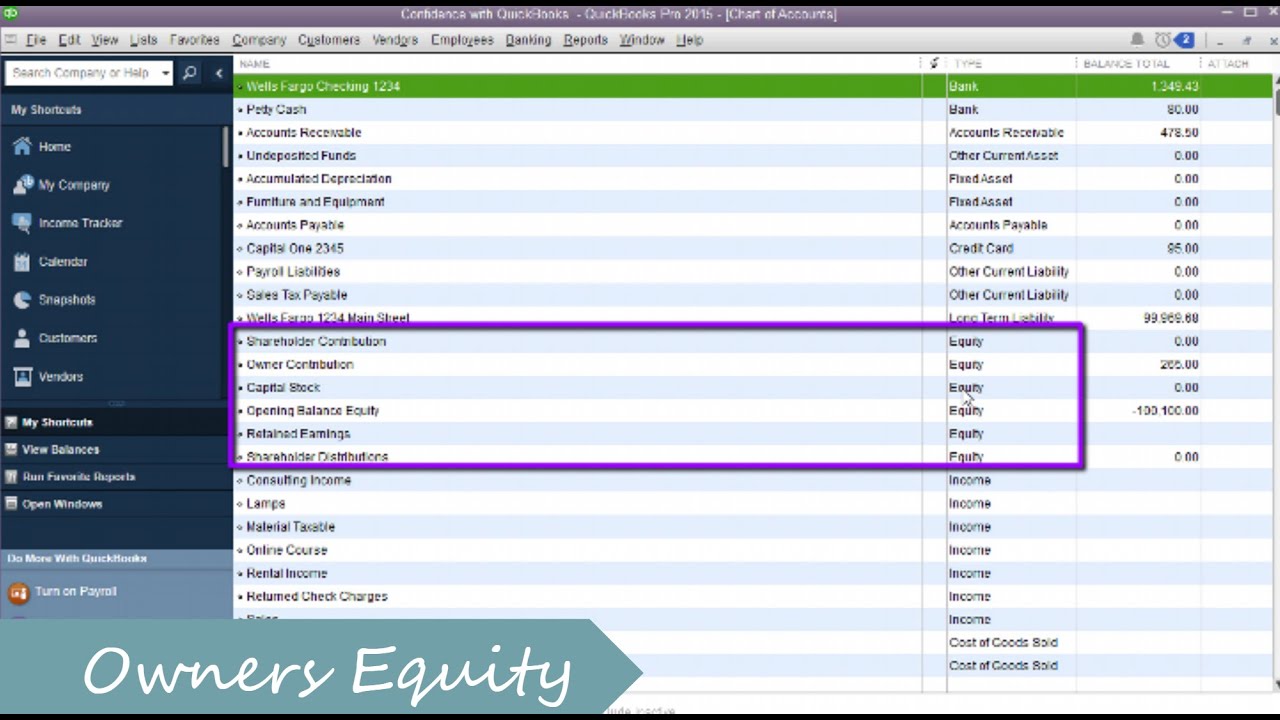

So your equity accounts could look like this. Smith Draws Step 2. In Q you and the business are considered to be a single tax entity if the data for both is in a single Q data file.

At the top click the Create menu and select Cheque or Expense. You have an owner you want to pay in QuickBooks. Here are some steps.

This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask. Click this link followed by. In my banking feed beneath neath my commercial enterprise account I can either.

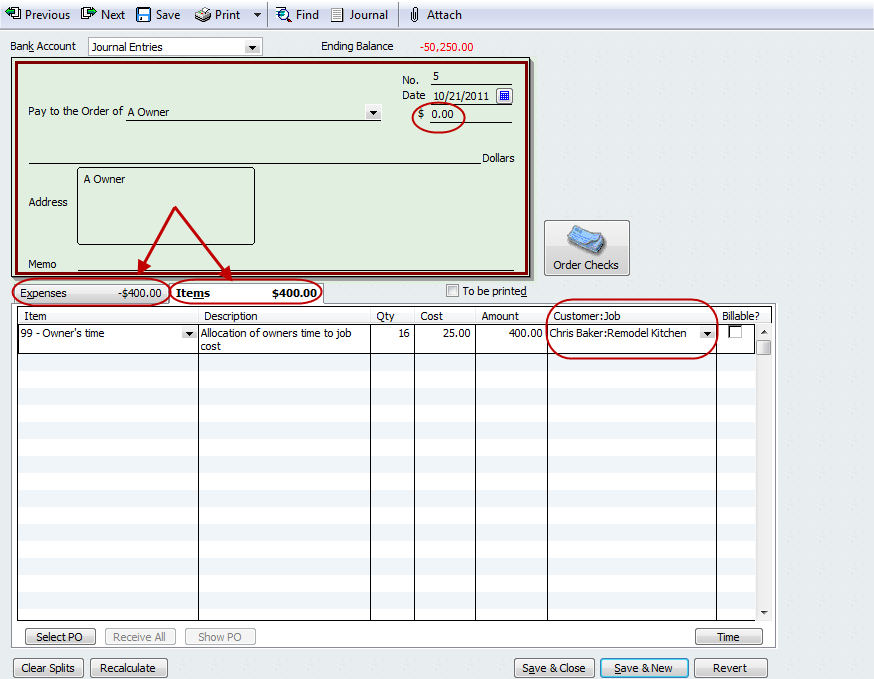

An owners draw account is an equity account in which QuickBooks Desktop tracks withdrawals of the companys. Click Save and close. 1 Create each owner or partner as a VendorSupplier.

Its simply a transfer of funds from your business pocket to your personal pocket. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. An owner can take all of their owners equity out of the company as a draw.

With the investment and draw account being sub accounts of owners equity. In the AMOUNT column enter the withdrawn amount. At the upper side of the page you need to press to New option.

In the ACCOUNT column enter Owners Equity or Partner Equity. Set up and process an owners draw account Overview. Learn about Recording an Owners Draw in Intuit QuickBooks Online with the complete ad-free training course here.

In fact the best recommended practice is to create an owners draw. Select Chart of Account under. Perform a Search in the Community on Owner Draw and read them.

If you have any video requests or tutorials you would like to see make sure to leave them in the com. After generating the report you can see a. 2 Create an equity account and categorize as Owners Draw.

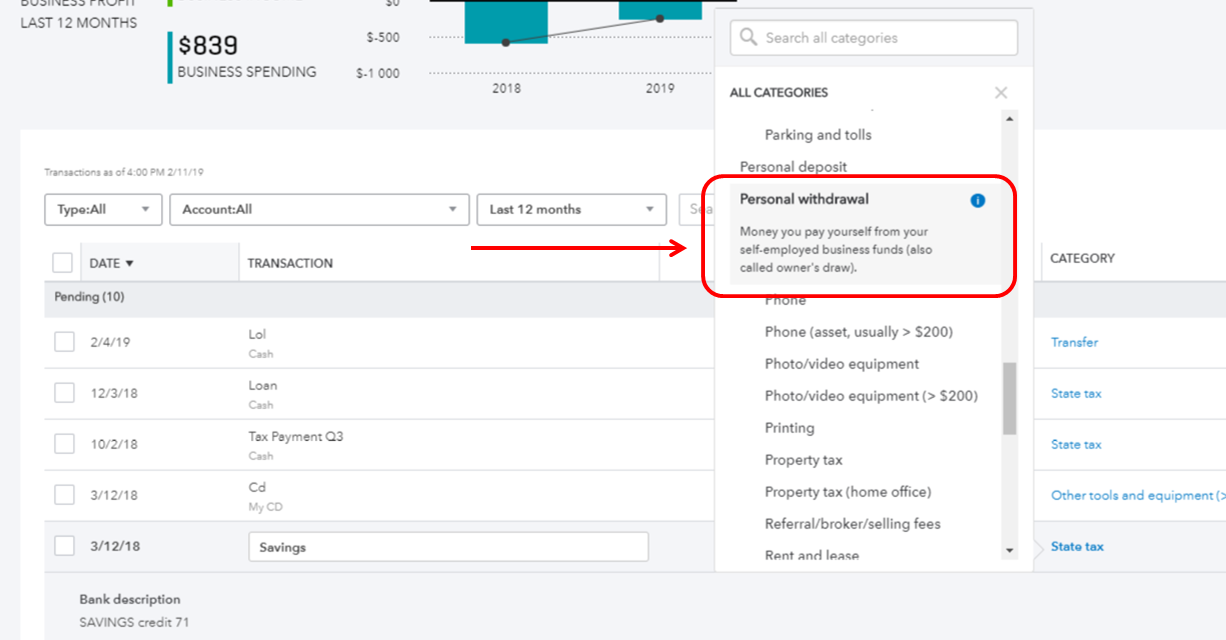

To create an owners draw log into your Quickbooks account and access Lists Chart of Accounts. When running Business and personal expenses report in QuickBooks Self-Employed QBSE only Transfers that youve tagged as Personal will be added in the report. Expenses VendorsSuppliers Choose New.

Quickbooks bookkeeping cashmanagementIn this tutorial I am demonstrating how to do an owners draw in QuickBooks------Please watch. To record a transaction between the business and owners account go into the Banking menu in Quickbooks and select the option titled Write Checks. If youre the business owner and want to record an owners draw youll basically want to write the check out to yourself like you are paying yourself with a check.

You may find it on the left side of the page. Dont forget to like and subscribe. Go to the Account details section.

So if you are a sole proprietor a partner or an LLC you can go for the owners draw. Open the chart of accounts and choose Add Add a new Equity account and title it Owners Draws If there is more than one owner make separate draw accounts for each owner and name them by owner eg. Track Billable Hours Categorize Expenses Organize Projects and More With Our Software.

Use your Gear icon. Pick the transaction click. At the bottom left-hand side of the screen youll see a menu with Accounts.

THUS theres no such thing as an Owners Draw. But they should first carefully evaluate whether doing so would prevent the business from having enough capital to continue operating. Ad Users Who Switch To FreshBooks Save Up To 265 Hours a Year On Invoicing and Accounting.

Setting Up an Owners Draw Account. You will pay the owner using an owners draw account. Also you cannot deduct the owners draw as a business expense unlike salary.

December 10 2018 0530 PM. In the drop-down of Account type you. Transfers that youve tagged as Business wont be included in the report.

Go to Chart of Accounts. The owners draw is the distribution of funds from your equity account. My trouble is this though I can file the switch in one in all methods and I do now no longer understand which one I ought to pick out.

Navigate to Accounting Menu to get to the chart of accounts page. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria. Answer 1 of 3.

The draw account is for tracking funds taken out use a different equity account for tracking funds in. Find the account go it its Action column and click View register.

How To Setup And Use Owners Equity In Quickbooks Pro Youtube

How To Record Owner Investment In Quickbooks Updated Steps

Quickbooks Tip Applying Owner S Time For Job Costing Long For Success Llc

How To Set Up Record Owner S Draw In Quickbooks Online And Desktop

Owner S Draw Quickbooks Tutorial

How To Record Owner S Equity Draws In Quickbooks Online Youtube

How Do I Enter The Owner S Draw In Quickbooks Online Youtube

Quickbooks Owner Draws Contributions Youtube

Quickbooks Learn Support Online Qbo Support How To Set Up An Owner S Draw Account In The Chart Of Accounts

Solved Owner S Draw On Self Employed Qb

Owner Capital Accounts In Quickbooks Online Otosection

Solved Owner S Draw On Self Employed Qb

Learn How To Record Owner Investment In Quickbooks Easily

How To Pay Invoices Using Owner S Draw

How To Record An Owner S Draw The Yarnybookkeeper

How To Record An Owner S Draw The Yarnybookkeeper

How To Complete An Owner S Draw In Quickbooks Online Qbo Tutorial Youtube